The State Tax Service has announced over 3,000 scheduled inspections in 2024, with 914 targeting individual entrepreneurs. Even more often, the tax authorities conduct actual inspections of sole proprietorships, which are also allowed under martial law.

After Law № 3219-IX came into force, the tax service has been checking online stores for the availability of cash registrars and the issuance of fiscal receipts to customers. In this article, we will consider what the tax authorities pay attention to and how individual entrepreneurs can prepare for such inspections.

How do the tax authorities check online stores?

The grounds for a tax audit of an online store may include:

- written complaints about the online store to the State Tax Service;

- oral complaints by calling the hotline;

- reports of violations in the StopViolationBot Telegram bot;

- violations detected during online monitoring.

The territorial bodies of the State Tax Service constantly monitor and analyze information on the facts of sale of goods via the Internet without the use of cash registrars.

Internet monitoring consists of the following steps.

- Search for online stores. The Tax Service constantly checks social networks and marketplaces (Prom, OLX, etc.). Most of all, the tax authorities are interested in sellers of high-risk goods, such as excisable goods (alcohol, tobacco products), electronic equipment, etc. To compile a list of online stores, the tax authorities are looking for sellers of certain types of goods in certain regions.

- Search and verification of tax information. The tax authorities try to find out the seller’s taxpayer identification number or other tax data e.g. by asking for payment details under the guise of a buyer.

The collected data is used to check the seller’s cash register in the tax registers, with controlled purchases made if necessary.

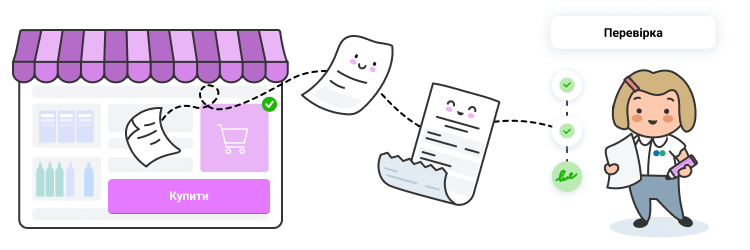

According to Article 15 of the Law «On Consumer Protection», the buyer has the right to receive complete and accurate information about the goods or services sold or provided by the sole proprietor, as well as information about the entrepreneur. Therefore, if the taxman does not receive the data from the seller, he transmits the information to the State Service of Ukraine for Food Safety and Consumer Protection. - Controlled purchase. A taxman buys goods in an online store to record that the seller did not provide a fiscal receipt.

- Actual inspection. The Tax Service conducts it at the place of registration of the sole proprietorship or instructs the State Tax Service department authorized to conduct inspections at this address.

Online store owners should monitor the mode of operation of the cash register. If a shift is open at the cash registrar during the actual inspection, it means that the store is operating at the registration address. If the entrepreneur is not there at the time, the tax authorities may consider this as an unlawful non-admission to the inspection.

How can sole proprietors avoid fines?

The key point in tax audits of online stores is compliance with the requirements of Law № 3219-IX. Tax authorities are interested in whether the online store has a cash registrar and whether the seller issues fiscal receipts.

As of December 1, 2023, the Tax Service has imposed UAH 1.65 billion in fines on entrepreneurs for violations when working with payment transaction registers (PTRs). The number of fines is almost 30 000.

After the end of martial law, the state will lift the moratorium on documentary inspections. The State Tax Service will be able to check whether the owner of an online store has complied with the requirement to fiscalize payments from October 1, 2023.

Therefore, to avoid fines, entrepreneurs should make sure that they are legally allowed to operate without cash registrars. The grounds for this are set out in Article 9 of Law № 3219-IX. In all other cases, an online store must register a cash registrar.

How does Vchasno.Kasa help to avoid fines?

Software-based cash registrars are the most convenient solution for online stores. On the marketplace, it can be combined with a cash register and no additional equipment is required.

Software-based cash registrars issue electronic receipts to customers: the seller sends them by email, messenger, or other means. If necessary, you can print an electronic receipt and send it with the goods.

An entrepreneur can register a cash registrar online within one day. The software automatically exchanges data with the State Tax Service server and generates tax reports.

Vchasno.Kasa offers solutions for different types of businesses.

Order a consultation to learn more about PRRO from Vchasno.Kasa.