Current legislation obliges sellers to issue receipts to customers. Complying with regulations is vital to avoid penalties. For entrepreneurs, understanding the different types of receipts is crucial, as they can mean the difference between fines and a smooth operation. Let’s consider this in the article.

Sales receipt

A sales receipt serves as proof of payment for goods or services. According to Article 3.15 of Law of Ukraine No. 265, sellers are obliged to provide a sales receipt upon the buyer’s request.

Current legislation does not define the form and content of sales receipts. This means that companies can develop their own templates for such receipts. you can even download a sales receipt form and customize it as needed. There’s no fine stipulated for failing to issue a sales receipt.

Requirements for a sales receipt

Paragraph 2 of Section 2 of Regulation No. 13 specifies the essential details that a sales receipt must contain. These include:

- name of the business entity;

- name and address of the business unit;

- for business entities registered as VAT payers, the individual tax number of the VAT payer. The number shall be preceded by the capital letters «PN»;

- for non-VAT payers — tax number or passport series and number (for those who have a stamp in their passport stating the right to make any payments by passport series and number). The number is preceded by the capital letters «ID» (identification data);

- quantity, cost of the purchased goods (received services);

- the cost of the unit of measurement of the goods (services);

- the code of the commodity subcategory according to the UKT ZED (in cases provided for by the current legislation);

- name of the goods (services);

- letter designation of the VAT rate to the right of the printed value of the goods (services) (for VAT payers);

- indication of the form of payment (cash, electronic payment instrument, credit, etc.) the amount of funds under this form of payment, and the currency of the transaction;

- the total cost of the purchased goods (services received) within the receipt, preceded by the word «TOTAL»;

- for VAT payers — a separate line with the letter designation of the VAT rate, the amount of the VAT rate as a percentage, and the total amount of tax on all goods (services) indicated in the receipt. At the beginning of the line, the capital letters «VAT» are printed;

- for retail trade entities that sell excisable goods and are registered as excise taxpayers, a separate line shall indicate the rate of this tax, and its total amount for all goods (services) indicated in the receipt. The name of the excise tax shall be printed at the beginning of the line;

- the serial number of the sales receipt, the date (day, month, year), and time (hour, minute) of the payment transaction;

- the inscription «SALE CHECK».

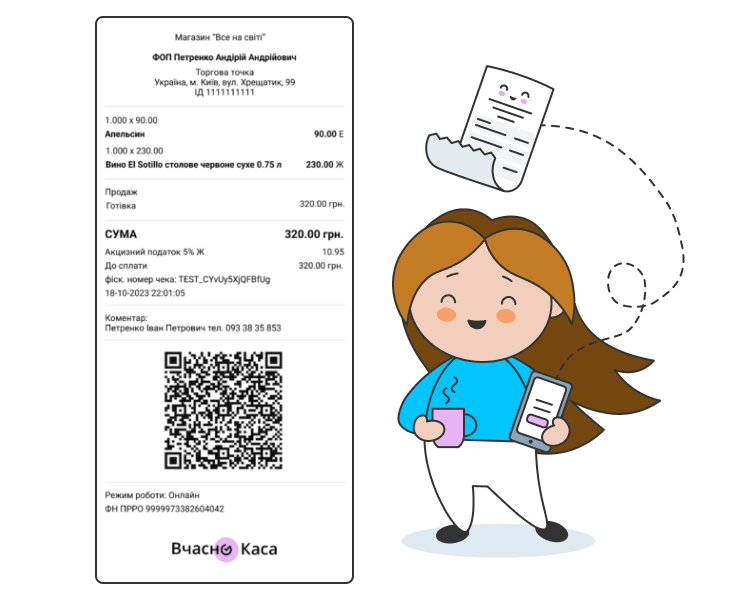

Fiscal receipt

In contrast to a sales receipt, which can be filled out manually, fiscal receipts are issued using a registrar of settlement operations (RRO) or a software registrar of settlement operations (PRRO). A fiscal receipt confirms that the data within it has been fiscalized, or transferred to the tax service server. The Law of Ukraine «On the Use of Registrars of Settlement Transactions in the Field of Trade, Catering, and Services» mandates that all sellers using cash registers and payment transaction registers must issue fiscal receipts to customers.

Requirements for a fiscal receipt

The form and details of a fiscal receipt are outlined in Regulation No. 13 and Order No. 329 of the Ministry of Finance. To sell goods and provide services, entrepreneurs use the form FKCH-1. Details of the form include:

- Name of the business entity.

- Name of the business unit.

- Address of the business unit.

- Individual tax number of the VAT payer.

- Tax number or series and passport number/ID card number.

- Quantity, unit price of the purchased goods/received services.

- Code of the commodity subcategory according to UKT ZED.

- The digital value of the barcode of the goods.

- Digital value of the barcode of the excise tax stamp on alcoholic beverages.

- Name of the product in the fiscal receipt, cost, letter designation of the VAT rate.

- Identifier of the acquirer and merchant or other details that allow them to be identified.

- Identifier of the payment device.

- Amount of commission fee (if any).

- Type of transaction.

- Details of the electronic payment instrument (payment card).

- Name of the payment system, authorization code, and transaction code in the payment system.

- Signature of the cashier.

- Signature of the holder of the electronic payment instrument (including a payment card).

- Form of payment, amount of funds, currency.

- Total cost of purchased goods/received services within the receipt.

- Alphabetic designation of the VAT rate, percentage of the VAT rate, and total amount of VAT for all goods/services in the receipt.

- Letter designation of the excise tax rate, excise tax rate, and amount.

- Rounding.

- To be paid.

- Fiscal number of the cash receipt/electronic cash receipt, date (day, month, year), and time (hour, minute, second) of the payment.

- QR-code with the MAC code of the receipt, date and time of payment, fiscal number of the cash receipt/electronic cash receipt, amount, and fiscal number of the RRO/PRRO.

- Indication of the mode of operation (offline/online).

- Control number (for PRROs).

- Factory number of the RRO.

- The fiscal number of the cash register on the receipt.

- The inscription «FISCAL CHECK» and the manufacturer’s logo.

The Law of Ukraine «On the Use of Registrars of Settlement Transactions in the Field of Trade, Catering and Services» allows entrepreneurs to issue fiscal receipts in paper or electronic form. Electronic receipts are generated using a PRRO. The seller sends them to the buyer via e-mail or messengers (Viber, Telegram, etc.). The buyer can also read the QR code from the screen of the device on which the PRRO is installed, or receive it on his phone using contactless data transfer technology. If necessary, the electronic fiscal receipt can be printed on a printer.

With the help of an electronic receipt, the buyer can check the seller on the website of the State Tax Service in the register of fiscal receipts.

What are the consequences for a seller for issuing a non-compliant receipt?

Failing to issue a fiscal receipt can lead to fines. A fiscal receipt missing essential requisites may not be recognized as a payment document.

The penalties for such violations are:

- 100% of the value of goods (works, services) sold with violations for the first offence;

- 150% of the value for each subsequent violation.

Therefore, it’s imperative for entrepreneurs to adhere to the legislative requirements when issuing fiscal receipts to steer clear of trouble with tax authorities.

Vchasno.Kasa offers solutions for different types of businesses.

Order a consultation to learn more about PRRO from Vchasno.Kasa.