Starting from March 1, 2025, according to Order №601 of the Ministry of Finance of Ukraine, entrepreneurs must switch to an updated form of fiscal checks.

What new mandatory details should be included in the check, what penalties are provided for non-compliance, and how these changes will affect the work with the PRRO — we will consider in the article.

Legal framework

On December 16, 2024, the Ministry of Finance of Ukraine issued Order №601, according to which the form of the fiscal check has changed. Until March 1, 2025, entrepreneurs could use the old form, but from now on, the check must contain updates that are described in detail in Order №13.

The purpose of changes in checks

Changes to the requirements for fiscal checks are aimed at making payment transactions more transparent, unifying their format, and simplifying control over the movement of goods and services.

Major changes in the fiscal check

The tax office has updated the requirements for fiscal checks: some details will no longer be displayed, while new mandatory elements have been added.

This does not create any additional hassle for users of software-based cash registers. In particular, Vchasno.Kasa has already updated the form of the check in accordance with the requirements of the tax office, so that cash desks can continue to work without significant changes.

Checks should also now include information on the weight of one tobacco product, the number of products in a pack, the strength of alcoholic beverages, the volume of goods in liters (bottles), and the buyer’s passport data. This applies exclusively to duty-free shops. Therefore, these details are not included in the list below.

![]()

Changes in checks regarding forms of payment

The biggest changes relate to payment methods. Now the payment details include two components: the form of payment and the payment method.

- According to Order №13 (line 18), there are three forms of payment: «cash», ‘non-cash’ or ‘OTHER’. The check also indicates the amount for each of these forms and the currency of the transaction

- Payment method specifies the method of payment, for example, a bank card, payment tool, coupon or token (Order №13, line 19).

💡 Quick tips for payment types in Vchasno.Kasa

Payment to IBAN from IBAN: non-cash (transfer from current account)

Payment to IBAN from IBAN: non-cash (transfer from current account)- Payment to IBAN from a card: non-cash (transfer from a card)

- Payment through the terminal: non-cash ( method — card)

- Payment via QR-code (generated by the bank): non-cash ( method — transfer via QR-code)

- Payment through payment systems or a QR code generated by a non-bank: non-cash ( method — LiqPay, NovaPay, Portmone, RozetkaPay)

- Payment by card on the website: non-cash (Internet acquiring)

- Payment via Tar ToPhone: non-cash ( by card)

![]()

Combining a cash register/PRRO with a payment terminal

The tax authorities have also clarified the definition of terminals that are connected or combined with cash registers/PRROs.

a payment terminal connected to a payment transaction registrar / software payment transaction registrar is a set of a payment terminal and a payment transaction registrar / software payment transaction registrar connected to it by means of any wired or wireless means of communication, which in the process of information processing actually interact by exchanging commands, messages, data packets

a payment terminal combined with a payment transaction recorder / software payment transaction recorder is a set of a payment terminal and a payment transaction recorder / software payment transaction recorder combined with it in one body or in one application, which in the process of information processing actually interact by exchanging commands, messages, data packets

If the payment terminal is connected to an accounting system or managed through services such as Device Manager, and it is this system that sends payment requests and receives the transaction result, you need to display payment data on the check. That is, manually or with the help of additional programs, add another requisite to the check. In Vchasno.Kasa, this process is automated – all data from the terminal is transferred to the check without additional actions on the part of the user.

![]()

Simplified product name in a fiscal check

Now it is possible to use the shortened name of a product in accordance with the State Classifier of Products and Services instead of specifying its full name on a fiscal check. This simplifies the display of names on checks and helps to optimize printing and sales accounting.

A simplified name of a product (service) is a word, a combination of words or a word and a numerical code that reflects the consumer characteristics of a product (service) and uniquely identifies the belonging of such product to a group of products and services defined by the State Classifier of Products and Services DK 016:2010

![]()

List of excise taxes for goods

The list of excise data for goods has been expanded to include additional parameters, such as the electronic stamp identifier or its serial number.

| ❌︎ Before | ✔︎ After |

| the digital meaning of the barcode of the excise tax stamp on alcoholic beverages (indicated in cases provided for by the current legislation); | the digital meaning of the barcode of the excise tax stamp (series and number) for alcoholic beverages or the unique identifier of the electronic excise tax stamp or the serial number of the electronic excise tax stamp (indicated in cases provided for by the current legislation); |

![]()

Web query in the QR code

Now, the QR code must include a search query that leads to the official website of the State Tax Service, where customers can view the check. In standard Vchasno.Kasa check forms, the QR code already contains such a link with the necessary data.

![]()

Displaying the change

From now on, you must display the change on a separate line on the check. Specifically, in the case of cash payments, you need to indicate the change and currency.

![]()

Fiscal number of the check

Now the fiscal number of the check must be displayed in the format: CHEK No. {FN}, where {FN} is the unique fiscal number of the check.

![]()

Removed details from the check

The fields «Cashier» and «Electronic Payment Instrument Holder», which were previously used to sign the cashier and the EMI holder, are no longer indicated on the check.

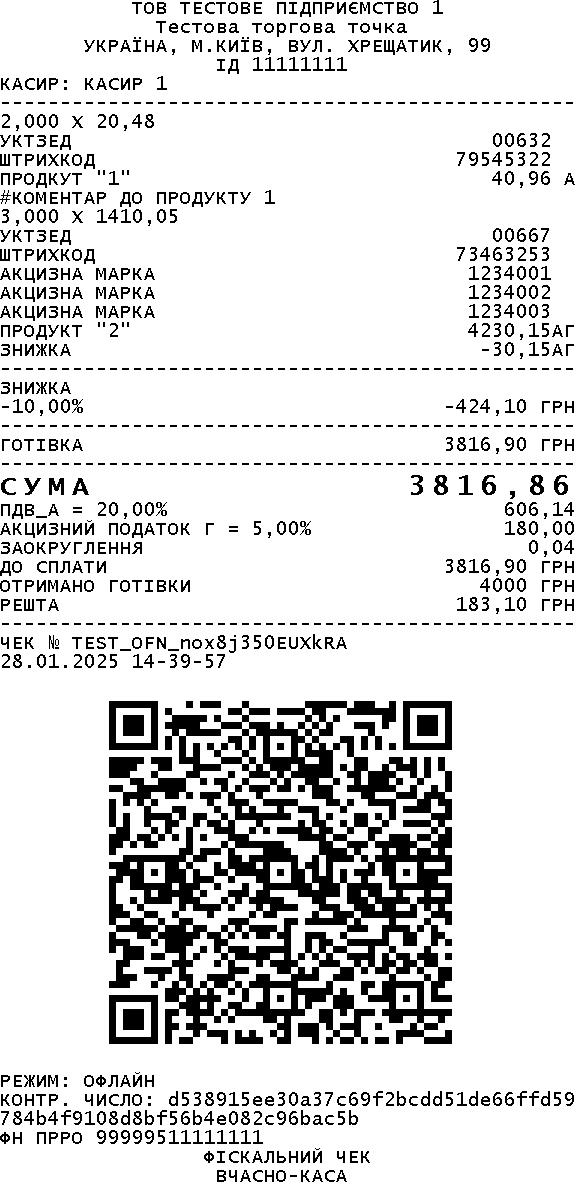

Check examples

Sales check, offline mode, cash payment

| ❌︎ Was | ✔︎ Became |

|

|

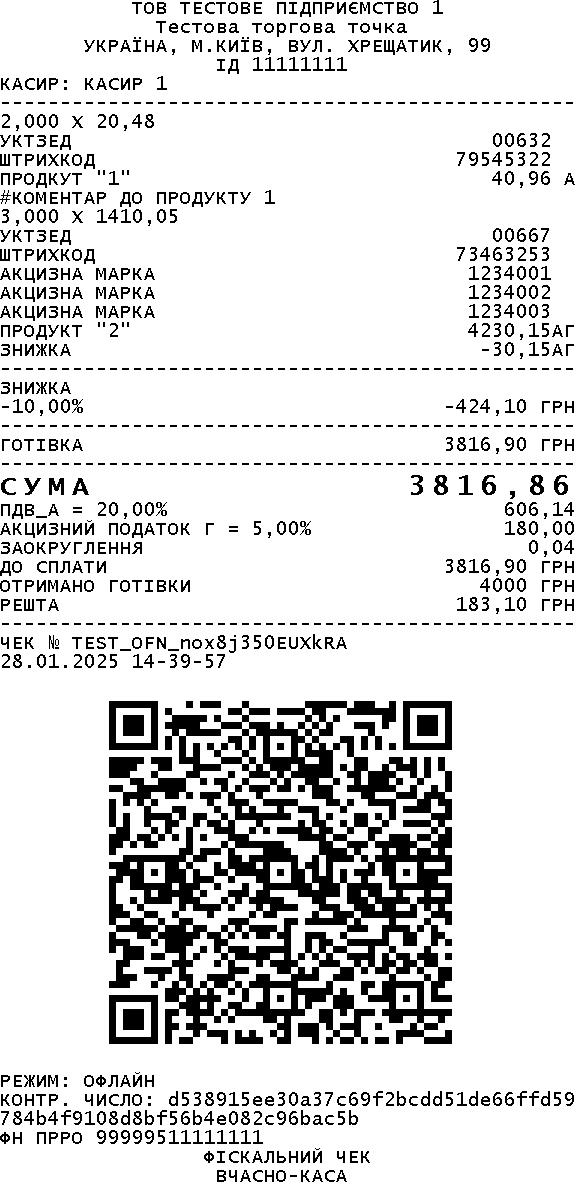

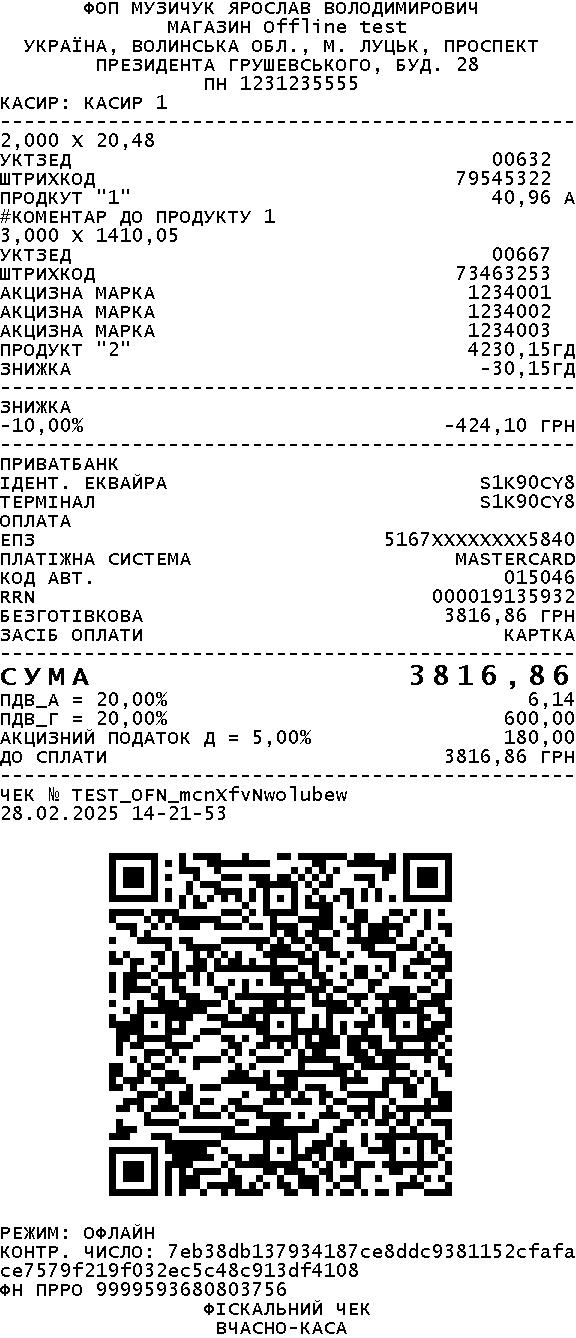

Sales receipt, offline, card payment with a terminal

| ❌︎ Was | ✔︎ Became |

|

|

Penalties for non-compliance with the new check form

Starting from March 1, 2025, entrepreneurs who issue old-style checks to customers will risk a fine. The absence of at least one required requisite in a fiscal document or non-compliance with the purpose of the document means that the check will not be issued to the buyer.

Violation of this rule is subject to penalties in accordance with subparagraph 1 of Article 17 of the Law on Cash Registers:

![]()

- 100% of the value of the goods sold or services rendered — if the violation is committed for the first time.

- 150% of the value of the goods sold or services rendered — for each subsequent violation.