Z-report and X-report are a daily cash routine that no entrepreneur can do without. In this article, we’ll take a closer look at what a Z-report and an X-report are, how they differ, when they are generated, and why it’s important to do it right.

What is an X-report?

An X-report is a document that displays the total number of sales and the amount of revenue (both cash and non-cash) from the beginning of the cash shift. It is also called a “non-redeemable report”.

The X-report is not submitted to the tax authorities, so entrepreneurs can print it an unlimited number of times to check the accuracy of the data before creating a Z-report.

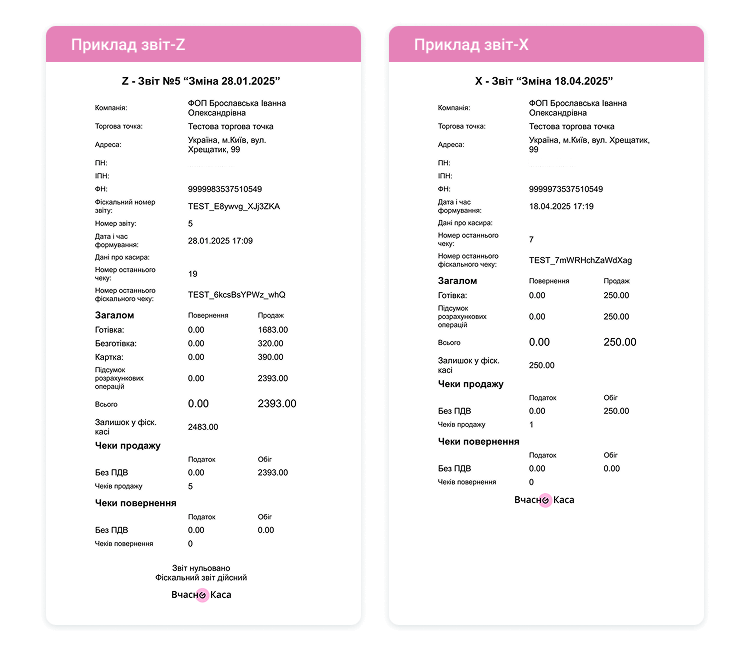

📩 What is the structure of the X-report?

The X-report contains summary information about cash transactions that can be generated at any time during the day. The report usually covers the following key blocks:

- Date and details — indicates the date the report was generated and basic information about the company.

- Sales — how many goods or services were sold, for how much, and which items were the most popular.

- Cash receipts — amounts received at the cash desk: both cash and non-cash payments.

- Expenses — shows where the money went: payments to suppliers, salaries, and other expenses.

- Results — helps to quickly assess the financial result for the period.

- Comments or analytics (if any) — sometimes a brief analysis or notes are added to better understand the numbers.

Such a report is not a fiscal report, but it allows an entrepreneur or cashier to quickly see the financial situation at the cash desk.

⏳ How long do you need to keep the X-report?

It is not necessary to keep the X-report, as it is not required by the tax authorities. It is only a current report for internal control that can be generated several times a day and is not recorded in tax reporting.

What is a Z-report?

Z-report is the main report generated by the cash register at the end of the working day, without which the shift is not considered complete. This report is also called a fiscal reporting check.

Two key actions take place during its generation:

- Data on all transactions are recorded in the fiscal memory of the hardware or software cash register. After that, it is no longer possible to change or delete them without damaging the device itself.

- The cash register’s RAM is reset to zero — all current shift data is erased, as it is already stored in the fiscal memory.

The Z-report must be generated daily at the close of the shift — until 24:00.

📩 What is the structure of the Z-report?

The Z-report has the following structure:

- General data — indicates the date the report was generated and a brief overview of cash transactions.

- Starting balance — the amount of funds available at the beginning of the reporting period.

- Cash flow —- shows all cash receipts and expenditures per shift.

- Ending balance — how much money was left in the cash desk at the end of the period.

⏳ How long do you need to keep a Z-report?

Z-reports must be kept for 3 years (1095 days) from the date of filing the tax return in which they were used. This requirement is stipulated by clause 44.3 of the Tax Code of Ukraine and clarifications of the tax authorities (letter No. 1112) and applies to both paper and electronic reports.

Why do we need Z and X reports?

The Z-report is a key element of fiscal accounting. It is the basis of tax legislation. It confirms all cash transactions, records profits, justifies expenses, and certifies compliance with the requirements of settlement procedures.

An X-report is a tool for internal control. An entrepreneur can generate it at any time during the day to reconcile sales amounts, check revenue, or simply make sure everything is going right.

Features of Z and X reports in PRRO

In software cash registers, reports are also generated, but this process is automatic every day. The user does not need to control the rule “one report per 24 hours” – the program itself monitors this.

It is not necessary to print out the Z-report in the case of PRRO – it is enough for the generated report to be transferred to the fiscal server of the State Tax Service and receive a confirmation of delivery.

If you stop working with the cash register, you need to take care of saving the archive – on an external medium or as a copy of the device on which the PTR was operating.

For example, the Vchasno.Kasa software PTR automatically saves reports in accordance with the requirements of the law – for three years

How to generate Z and X reports in Vchasno.Kasa?

In the Reports section of Vchasno.Kasa, you can quickly and conveniently generate 8 types of reports in just a few clicks. To get the report you need, select the type of report, set the date, point of sale, and cash register for which you want to receive information.

After that, click the Generate Report button and the system will automatically generate a file that will be downloaded to your computer immediately.

What are the penalties for not having a Z-report?

There is no direct fine for failing to print a Z-report. But problems can arise due to other related violations:

![]() Failure to close a shift can result in a fine of UAH 510 for the first violation and UAH 1,020 for each subsequent violation.

Failure to close a shift can result in a fine of UAH 510 for the first violation and UAH 1,020 for each subsequent violation.

![]() Failure to keep primary documents. The penalty is UAH 1020 for the first violation and UAH 2040 if repeated within a year (clause 121.1 of the Tax Code, letter No. 1112).

Failure to keep primary documents. The penalty is UAH 1020 for the first violation and UAH 2040 if repeated within a year (clause 121.1 of the Tax Code, letter No. 1112).