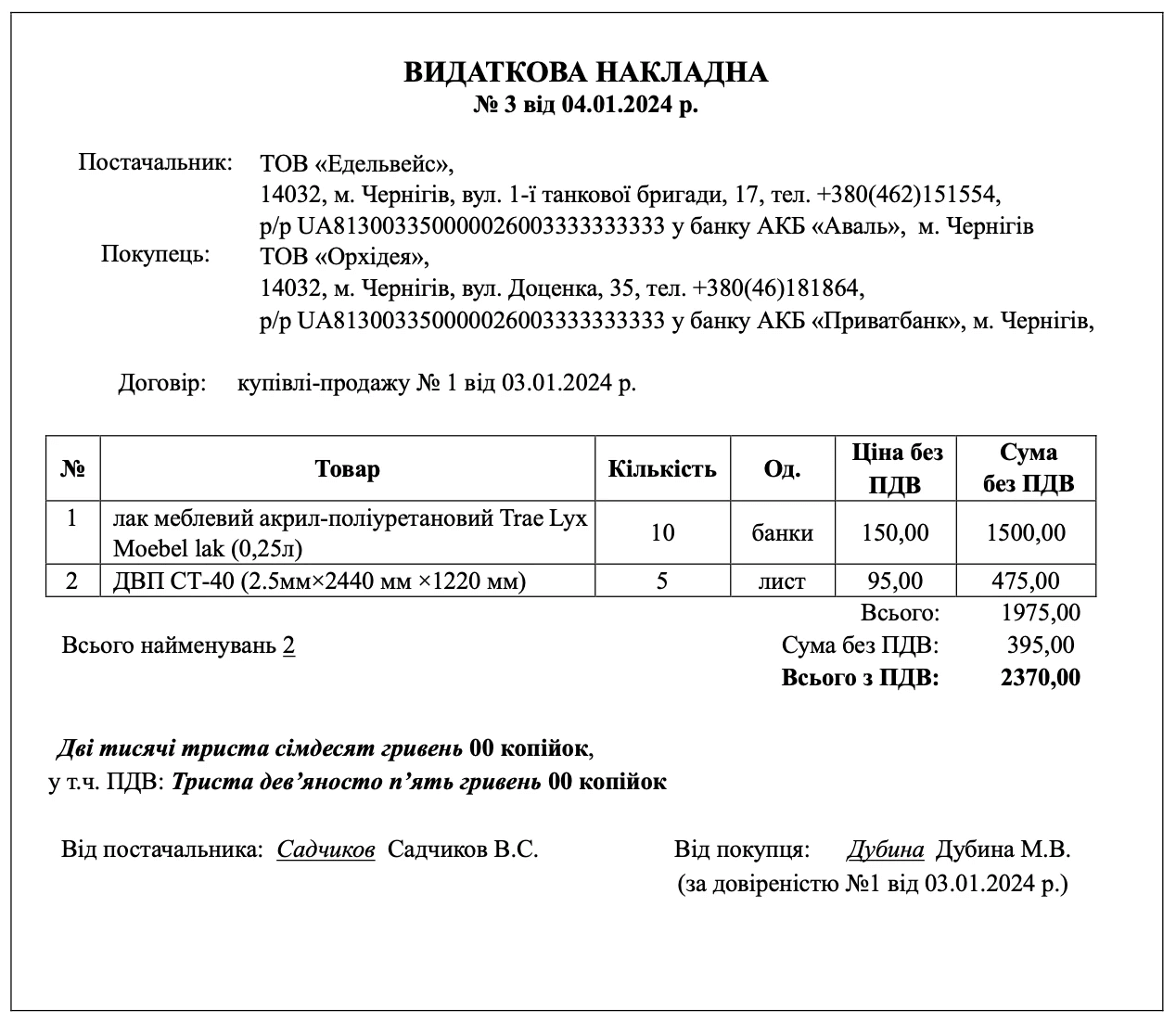

A delivery note is a primary accounting document that confirms the transfer of goods. It is often used by suppliers when cooperating with retail chains. In this article, you will learn why a delivery note is necessary and how to properly execute it.

Delivery note in the system of primary documents

During the supply of goods, the parties execute primary documents to certify business transactions, such as shipment, transportation, receipt of a batch of goods, etc. Correctly executing primary documents helps to prevent issues with tax authorities and litigation with partners.

However, the law does not provide clear guidance on which documents should accompany the supply of goods and at what point they should be drafted (during shipment, upon arrival at the warehouse, etc.). Consequently, suppliers and chains are guided by the logic of their own business processes when preparing documents.

In the modern business environment, a number of document workflow schemes have been developed for the supply of goods. The most common methods utilize either a delivery or a receipt note. A delivery note is generated by the supplier upon shipment of the goods, while a receipt note is created by the chain upon arrival of the goods at the warehouse.

What is a goods delivery note?

A delivery note serves to confirm that the supplier has transferred the goods to the buyer. It contains all the information required for the transaction to be accounted for, including the name and quantity of the goods, price, place of delivery, and date of the business transaction.

A delivery note is used to record the movement of material assets, both within the company (internal delivery notes) and outside the company (external delivery notes). Accordingly, this document is widely applicable in accounting.

Delivery note in electronic form

In accordance with the Law “On Accounting and Financial Reporting in Ukraine,” invoices and other primary documents may be created in electronic form. To this end, trading companies employ a range of digital services.

As an example, the Vchasno.EDI service allows users to fully customize their supply chain and automatically generate all the necessary electronic documents. The service can be tailored to suit the company’s specific document workflow requirements, whether that be based on a delivery note, receipt note, or other document type. The parties affix electronic signatures to electronic documents, thereby conferring upon them full legal force.

It is not uncommon for errors, data mismatches in invoices, and other issues to arise when working with suppliers. Vchasno.EDI automatically generates primary documents, thereby minimizing the risk of errors in them. In the event of a discrepancy being identified following the delivery of goods to the warehouse, the parties involved can draw up a discrepancy report or create a new delivery note. Vchasno.EDI allows this process to be completed in just a few minutes.

Vchasno.EDI integrates with numerous accounting systems. This enables users to create delivery notes not only within the service itself, but also in a convenient external environment (such as BAS, BAF, or other accounting software). This functionality enables accountants to monitor orders and access all associated documentation.

The introduction of electronic consignment notes (TTNs) in Ukraine is also increasing the relevance of electronic delivery notes. As a reminder, the government has been implementing eTTN for domestic cargo transportation since May 30. Following the end of martial law, the government plans to fully transfer all cargo transportation in Ukraine to electronic TTNs.

Electronic TTNs provide a clearly defined signature sequence, from the sender through the carrier to the recipient. Suppliers can simultaneously sign eTTNs and electronic delivery notes online in the EDI service when preparing cargo documents. This is in line with the standard practice for the supply of goods: the delivery note certifies that the supplier transfers ownership of the goods, while the eTTN certifies that the driver will deliver them legally, along a certain route, in compliance with all transportation rules.

Learn more about Vchasno.EDI

Get acquainted with all the features of Vchasno.EDI and start using it.

What details should a delivery note contain?

At this time, the state has not approved any version of the delivery note. A document is deemed valid if it contains all the requisite details. As a result, companies are developing their own forms for it. As is often the case in practice, companies tend to use forms derived from their accounting systems.

The requirements for executing a delivery note are set forth in part 2 of Article 9 of the Law of Ukraine “On Accounting and Financial Reporting in Ukraine” and clause 2.4 of the Regulation on Documentary Support of Accounting Records No. 88.

A delivery note must contain the following mandatory details:

- name of the document;

- date of the document — the date on which the business transaction was actually performed must be indicated. VAT payers should pay special attention to the date of execution, as they incur tax liabilities from the date when the goods begin to move from the seller to the buyer;

- the name of the company transferring the goods;

- the content and scope of the business transaction;

- for VAT payers — the amount of VAT;

- unit of measurement of the business transaction;

- positions of persons who performed the business transaction;

- personal signatures of the persons who performed the business transaction.

A delivery note is created in two counterparts: one for the supplier and one for the chain. The individuals responsible for shipping and receiving the goods must sign both counterparts.