In 2023, the rules for preparing expense reports changed in Ukraine. The new rules for confirming business trips came into force on April 1, and on July 13, companies began using a new form of expense report. In particular, they can now be submitted electronically. In this article we will discuss what new rules should be considered when preparing advance reports.

What has changed in 2023?

On April 1, 2023, the Law of Ukraine No. 2888-IX «On Amendments to the Tax Code of Ukraine and Other Legislative Acts of Ukraine on Payment Services» came into force. It sets out clause 170.9 of the Tax Code of Ukraine in a new version. This clause regulates the taxation of the amount of excessively spent funds received for a business trip or for a report that was not returned within the established time limit.

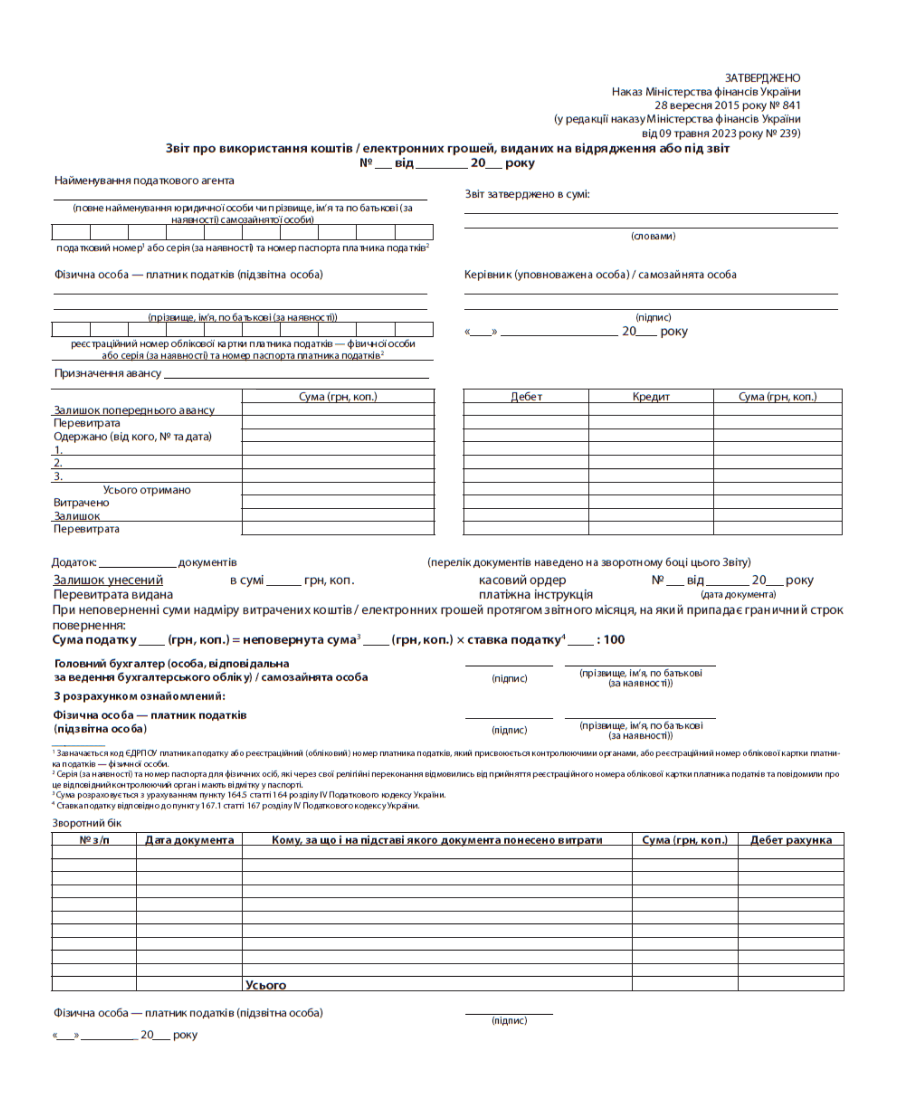

The form of the advance report has also changed. The new form was approved by the order of the Ministry of Finance No. 239 dated 09.05.2023.We’ll explore these procedural shifts in more detail.

When an advance report is required?

The new version of clause 170.9.4 of the Tax Code defines the list of cases when an employee must prepare an advance report. In particular

in the presence of taxable income determined by subparagraph 170.9.1 of the Tax Code, to calculate the amount of personal income tax (and therefore, the amount of withholding tax);

in cases where the taxpayer uses cash over the amount of daily expenses (including cash received through the use of payment instruments).

Clause 170.9.1 of the Tax Code defines the conditions under which income is subject to taxation. In such cases, the amount of personal income tax is reflected in the advance report. In addition, a military fee is levied on excessively spent funds.

The requirement to prepare an expense report when using cash over the per diem amount applies to situations where an employee receives per diem at the company’s cash desk, withdraws it from a corporate bank card, or similar circumstances, essentially, any instance where a cash advance is involved.

However, if an employee utilizes payment instruments (including corporate or personal payment instruments) for non-cash payments and/or cash withdrawals within daily expenses without generating taxable income, an advance report is not mandatory. In this case, employees submit expense-related documents to the accounting department, accompanied by a description of the expenses. The head of the company then approves these expenses through an order or instruction. It’s important to note that some companies may still require advance reports even if not mandated by tax regulations

New deadlines for preparing an advance report

The reporting procedure, established by Order No. 239, also introduces new deadlines for advance reports. Under the new rules, these reports must be submitted by the end of the month following the month in which the taxpayer:

- completes a business trip;

- completes the performance of a separate civil law transaction on behalf of and at the expense of the person who issued the funds/electronic money for the report.

If the payment service provider debits funds/electronic money for expenses after the taxpayer has completed the business trip or civil law transaction, the submission deadline is extended by one more calendar month.

Advance report in electronic form

The updated regulations now allow for the submission of advance reports in both paper and electronic formats. The key provision is found in the new version of Clause 170.9.4 of the Tax Code:

«A report on the use of funds/electronic money issued for a business trip or under a report shall be prepared and submitted within the time limits specified in sub-clause 170.9.3 of this clause by the taxpayer (in paper or electronic form (in compliance with the requirements of the Laws of Ukraine «On Electronic Documents and Electronic Document Management» and «On Electronic Trust Services») in the form established by the central executive body».

Additionally, section 5 of the Reporting Procedure permits the submission of advance reports signed with electronic signatures.

«Persons (manager (authorized person) / self-employed person, chief accountant/person responsible for accounting) certifying the correctness of the preparation/submission of the Report shall sign the Report by applying a handwritten signature or an electronic signature in compliance with the requirements of the Laws of Ukraine «On Electronic Documents and Electronic Document Management» and «On Electronic Trust Services».

The new regulations allow the use of EDI services to submit advance reports. This greatly simplifies the work of accountants. With the help of EDI services, employees can submit expense reports remotely, which helps to meet the deadlines for reporting on the funds spent.

When working with electronic expense reports, an accountant can better control the correctness of filling out the form. If an employee makes a mistake, it can be quickly corrected in a remote format.

With the help of EDI services, an accountant can conveniently store expense reports and other documents. For example, the Vchasno.EDI service allows users to quickly find the document in the archive by requisites or select all reports for a certain period.

Apply for a detailed presentation

Learn how electronic document management can simplify and speed up the exchange of documents in your company