In document flow with suppliers, retail chains often use purchase invoices. These are primary accounting documents that confirm receipt of a consignment of goods. This article explains how to fill out purchase invoices correctly.

Purchase invoice in the source document system

To track the movement of goods from the supplier to the network, the parties draw up source documents — invoices, acts, bills, etc. Source documents record all business transactions that occur in the process of supplying goods and become the basis for tax accounting. The need to draw up source documents for each transaction is enshrined in the Law of Ukraine «On Accounting and Financial Reporting in Ukraine».

During the supply of goods, document flow between the supplier and the chain can be organized according to two basic schemes.

![]()

Scheme with an expense invoice

A classic document flow scheme for the supply of goods. When shipping goods, the supplier creates an expense invoice. It confirms that the goods have left the supplier’s warehouse. Upon arrival of the goods at the chain store, its representative (or carrier) signs the expense invoice, confirming receipt.

💡 The main focus in this document flow scheme is on the fact of shipment from the supplier’s warehouse.

![]()

Scheme with a purchase invoice

This scheme is often used by large retailers to optimize their business processes. In this case, the retail chain itself creates a purchase invoice at the moment of actual receipt of goods at its warehouse. The supplier delivers the goods, the chain’s employees check their quantity, quality, and compliance with the order, and only then do they generate a document certifying the receipt of the goods on the chain’s balance sheet.

💡 The key point in this scheme is the fact of receiving the goods at the buyer’s warehouse. This scheme allows chains to avoid discrepancies between what was shipped and what was actually received.

The choice of a specific scheme depends on the business processes adopted in the chain and the agreements between the parties. The main difference lies in who creates the source document recording the transfer of ownership of the goods and at what point. When choosing a document flow scheme, the company specifies in its internal office management regulations which source document certifies the business transaction in that company.

Large chains often insist on using purchase invoices in order to have full control over the process of receiving goods. The use of purchase invoices gives them the following advantages:

- Accurate accounting of goods arriving at a store or warehouse. By recording the actual quantity of goods, the chain avoids further reconciliations and adjustments.

- Optimization of warehouse operations. Working with a purchase invoice allows you to standardize the acceptance process for all suppliers. Warehouse employees follow a clear algorithm: they accept the goods, check them, and then issue a delivery note. This speeds up the unloading of goods.

- Financial control. The chain pays only for goods that it has physically received and entered into its accounting system via a delivery note. This prevents situations where payment is made based on the supplier’s document, and then a discrepancy in the data is discovered, requiring complex mutual settlements and returns.

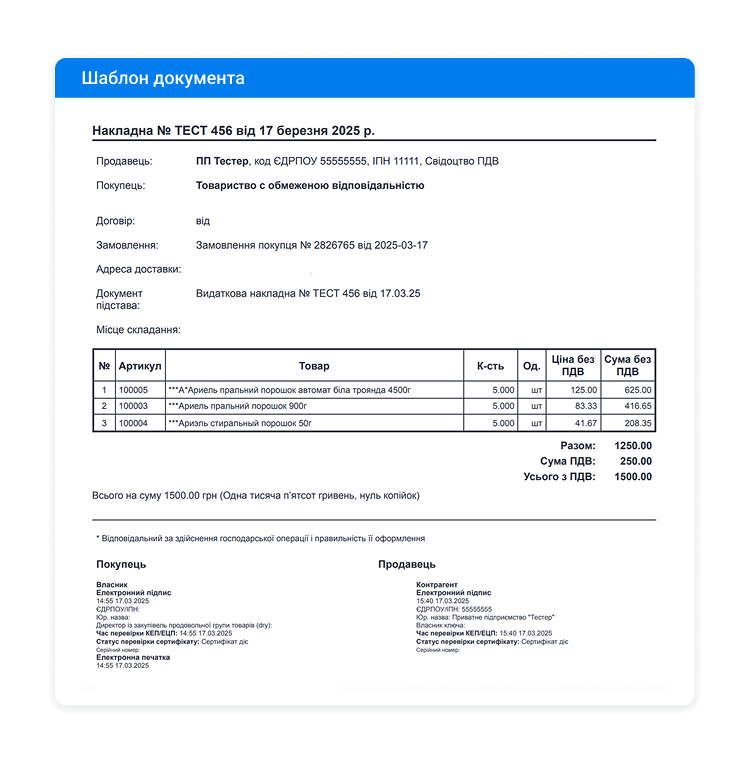

What details must a purchase invoice contain?

The Law of Ukraine «On Accounting and Financial Reporting in Ukraine» does not distinguish between the concepts of «purchase» and «expense» invoices. Both documents are source ones, i.e., they record business transactions.

The chain uses income invoices to prepare tax reports. However, for an invoice to be legally valid, it must contain the following mandatory details:

- The name of the document.

- The date of issue.

- The name of the enterprise on behalf of which the document was drawn up.

- The content and scope of the business transaction, the unit of measurement of the business transaction:

- full name (nomenclature) of the goods;

- unit of measurement (pieces, kilograms, liters, etc.);

- quantity;

- price per unit;

- total amount.

- Positions and surnames of persons responsible for the economic transaction and the correctness of its execution.

- Personal signature or other data that allows identifying the person who participated in the economic transaction.

Purchase invoices also indicate the supplier’s details, the numbers of the contracts on the basis of which the supply is carried out, and other important information required by the network’s business processes.

Sample income invoice:

Electronic purchase invoice

Tax legislation allows source documents to be kept in electronic form, provided that the requirements for electronic document management are met. This opens up wide opportunities for suppliers to use EDI services that automate the entire process of supplying goods.

For example, the Vchasno.EDI service allows retailers to configure electronic data exchange for any document flow scheme — with purchase and expense invoices, etc. The service automatically generates all source documents accompanying the delivery of goods. The supplier and the chain apply electronic signatures to the documents. This gives the documents full legal force: they are accepted by the tax service, courts, and other state bodies.

Working with electronic purchase invoices in the Vchasno.EDI service gives retail chains the following advantages:

- Data accuracy. Networks usually issue invoices based on the supplier’s delivery notes. When a network employee transfers data from a paper document to the accounting system, they may make mistakes in the names of goods, quantities, and prices. This leads to discrepancies in accounting, the need for additional checks and adjustments.With Vchasno.EDI. Delivery data is automatically transferred via the service from the supplier’s accounting system to the chain’s one. This eliminates the possibility of human error.

- Resource savings. Working with paper invoices requires spending on paper, printing, and sending documents. If a purchase invoice is lost on its way from the warehouse to the accounting department, it takes much longer to record the goods and carries tax risks for the chain.With Vchasno.EDI. Companies do not spend money on paper and document logistics. The workload on accountants and managers is reduced, allowing them to focus on more important tasks.

- Control of primary document circulation. When working with paper invoices, it is difficult to track the status of documents. It is unknown whether the partner has received the invoice, whether it is being processed, or whether it has been lost.With Vchasno.EDI. The status of the document (sent, accepted, rejected, etc.) and the status of its signing are always visible in the system. This greatly simplifies communication with partners and allows you to quickly resolve any issues.

- Document storage security. Paper archives are vulnerable to physical risks: fires, floods, destruction due to military action. If a company produces a large number of documents, it is practically impossible to restore them.With Vchasno.EDI. documents are stored in secure data centers on Amazon (AWS) servers located in Europe. The service has the highest level of information security. Regular data backups ensure that electronic documents will not be lost under any circumstances.

Purchase invoices help keep accurate records during the delivery of goods. And thanks to the Vchasno.EDI service, their processing becomes as convenient and efficient as possible. Working with electronic invoices allows retailers to optimize their business processes, reduce costs, increase data accuracy, and ensure reliable document storage. Switching to electronic document management in Vchasno.EDI is a modern solution for anyone seeking efficiency and control in trade.