Content

- Introduction

- 1. What are the source documents?

- 2. What are the requirements for source documents in electronic form?

- 3. What are the retention periods for source documents in electronic form?

- 4. How do you exchange source documents in electronic form?

- 5. Who has the right to sign the source documents?

- 6. How to submit electronic source documents for a tax audit?

Accountants are increasingly using electronic document workflow services (ODE services) in their work. This is facilitated both by the government’s policy of digitalization and by the needs of business in the quick exchange of documents.

How is the circulation of electronic source documents regulated? We answer frequently asked questions.

1. What are the source documents?

Source documents are documents in paper or electronic form containing information on business transactions.

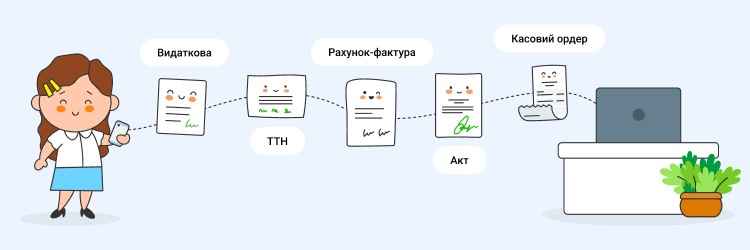

The current legislation does not contain a complete list of source documents. However, in accounting practice, the following are most often used:

- expenditure invoice – confirms the fact of receipt or transfer of goods or services;

- bill of lading (TTN) – records the act of transportation of products from the supplier to the customer;

- invoice – informs the counterparty about the goods or services he is offered to pay for;

- statement of acceptance of work performed – records the completion of work or services and their acceptance by the customer’s party in terms of quality and quantity;

- cash voucher (cash receipt voucher and cash issue voucher) – used to formalize the receipt and disbursement of funds to the cash office, etc.

If there is no or incomplete information about a committed business transaction in a document, such a document cannot be considered as a source document in accounting.

2. What are the requirements for source documents in electronic form?

Article 9 of the Law of Ukraine “On Accounting” states that for source documents in electronic form the imposition of an electronic signature or seal of an authorized person is mandatory.

In the same article of the Law there is a list of mandatory details of the source document – both electronic and paper. They provide the document with legal force. Moreover, a document may also contain additional details specified in Regulation No. 88.

| Mandatory details: | Additional (optional) details: |

|

|

3. What are the retention periods for source documents in electronic form?

According to Article 44 of the Tax Code of Ukraine, the retention period of e-documents on electronic media should be not less than the period established by the legislation for the corresponding documents on paper. That is, not less than 1095 days (2555 days – for documents and information required for tax control over transfer pricing).

Art. 13 of the Law of Ukraine “On Electronic Documents and Electronic Document Workflow” establishes the following requirements for storing electronic documents:

- information contained in electronic documents must be available for its subsequent use;

- it should be possible to restore an electronic document in the format in which it was created, sent or received;

- information allowing to establish the origin and purpose of an electronic document, as well as the date and time of its sending or receiving must be stored, if available.

4. How do you exchange source documents in electronic form?

Before sending electronic source documents, you should agree on the legal issues. In particular, you should sign an additional agreement with the counterparty that you will exchange electronic documents.

A company employee creates an electronic document in the ODE service, signs it with an electronic signature (QES) and sends it to the counterparty, who also imposes a QES. Once signed by all parties, the document is stored in a cloud archive.

Companies with a large document workflow that create source documents in accounting systems can integrate these systems into the ODE service. For instance, the function of such integration can be found in the Vchasno service.

For more details on how to exchange electronic documents in the Vchasno service, see the instructions.

5. Who has the right to sign the source documents?

According to Article 8 of the Law of Ukraine “On Accounting”, the head of the company is responsible for ensuring that the facts of all business transactions are recorded in the source documents.

Clause 2.12. of Regulation No. 88 allows the head to approve the list of responsible persons who have the right to authorize (sign source documents) for the implementation of business transactions. Such possibilities are fixed by the order on the right to sign source documents for the company.

ODE services used for the exchange of source electronic documents between counterparties usually simplify the signing procedure. For example, the Vchasno.KEP service has a function for administering signatures. A responsible employee can grant the right to sign in the service, revoke it after termination of authorization, etc.

6. How to submit electronic source documents for a tax audit?

The procedure for the submission of documents is specified in the Order No. 1393 of the Ministry of Finance. Electronic documents together with their description can be transferred on a USB flash drive or other electronic media, as well as sent by email. Formats of e-documents for tax audits are defined in Article 85 of the TCU.

After receiving the documents, the tax inspectorate decrypts them and checks the content of the archive with the description. Verification of the integrity of the electronic document is done by checking the integrity of the QES (Article 12 of the Law of Ukraine “On Electronic Documents and Electronic Document Workflow”). After that, the tax office sends a letter to the taxpayer stating the receipt of electronic documents and processes them.

The tax inspector can submit a request for a paper copy of the source document according to paragraph 6 of Article 9 of the Law of Ukraine “On Accounting”. He does this no later than five working days before the inspection is finalized (paragraph 85.4 of Article 85 of the TCU).

In such a case, print out the electronic document and certify the paper copy:

- put marks “Paper copy of the electronic document” and “conforms to the original” (without quotation marks);

- specify the position, name and surname of the person certifying the document, date;

- sign the copy with a personal signature.

Practice shows that recently more and more companies successfully pass tax audits with electronic documents. For tax inspectors it is not the form of the document that is important, but the legally correct registration of business transactions and the presence of all necessary details in the document.

ODE services help accountants to organize work with the source documents. So let us show you how to quickly convert source documents into electronic format with the help of the Vchasno service.

Read also: Successful tax inspection of e-documents. Experience of Zakúpki.Prom.ua

Apply for consultation

Please contact our experts for detailed instructions on how to use Vchasno.ODE to arrange work with contracts in your company.

Popup title

Thank you! We will contact youas soon as possible